Last night, President Trump signed the “Digital Assets” executive order (EO), and let’s just say Bitcoiners are feeling… sour. Initially, rumors swirled that this might be the long anticipated Strategic Bitcoin Reserve (SBR) legislation. But nope — not even close. Bitcoin reserve didn’t get a single mention.

Instead, the EO said:

“The Working Group shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts.”

Translation: This EO looks like a vague “let’s study shitcoins” roadmap rather than a bold step toward a Strategic Bitcoin Reserve. If you were hoping for a nation state orange pill moment, this ain’t it.

But before you rage tweet, take a deep breath. There is a silver lining. The EO does outlaw CBDCs — a huge win for freedom money and a more Bitcoin-aligned future.

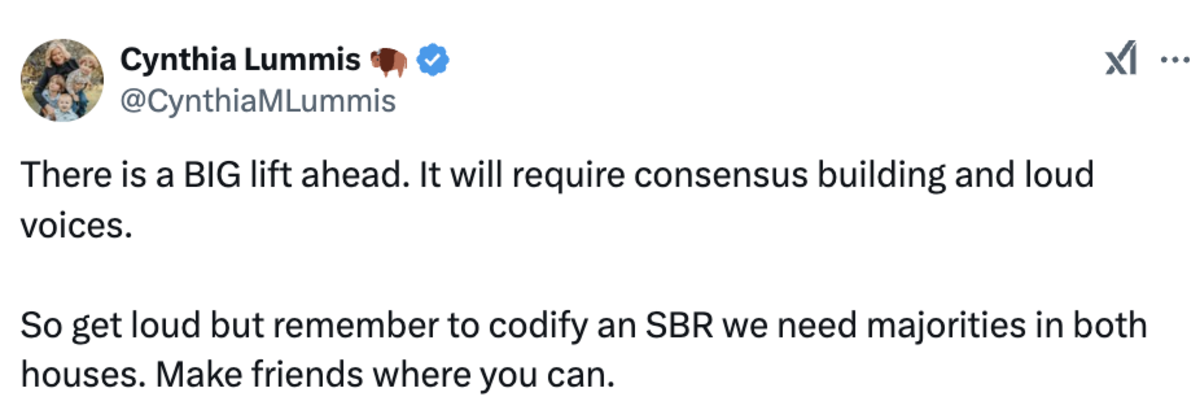

And, as Senator Cynthia Lummis reminded us yesterday, her Strategic Bitcoin Reserve Bill is “a BIG lift”:

Why is this good news? Let’s break it down:

- Executive Orders Are Fragile: EOs are quick to implement but can be easily reversed by the next administration. They’re political Post-it Notes, not permanent fixes.

- Legislation Is Durable: Laws passed through both houses of Congress are far harder to repeal. Lummis’ long term strategy aims to cement Bitcoin’s role in the U.S. economy for generations, not just the next election cycle. She is taking the low time preference route, and I salute her for that.

Senator Lummis said it herself in an X DM she allowed me to share:

“Even if the EO had been an outright Strategic Bitcoin Reserve, the next administration (after Trump) could undo it (what’s done administratively can generally be undone administratively). So, in order to get the 20-year minimum HODL, which my bill calls for, and meaningfully address America’s debt, we have to go through the legislative process (passage through both the House and Senate) to get it to the President’s desk for signature.

It’s really important that we have momentum for a marathon, not a sprint. I don’t want people getting discouraged. The trajectory is to the moon but we have to stick with it and work the process. Lots to do but the EO was a great jumping-off point to get us there.”

So yes, the EO feels like a quick win for crypto execs eager to pump their bags. But the real fight for Bitcoin’s future is just beginning.

A congressionally approved SBR is better than an SBR via Executive Order. Full stop!

Bitcoin has always thrived in adversity. Whether it’s bans, restrictions, or now the “national digital asset stockpile” nonsense, Bitcoin’s resilience is unmatched. As Senator Lummis works to push the Strategic Bitcoin Reserve Bill through Congress, individual states are already leading the charge. States are introducing Bitcoin-specific reserve legislation, not vague “digital asset” plans.

Meanwhile, global momentum is building. Putin didn’t say, “no one can control digital assets,” he said “no one can control Bitcoin”. Nation states aren’t about to FOMO into $TRUMP or FARTCOIN. They’re watching, learning, and inching closer to Bitcoin.

Bitcoin wins because it is superior money. Every piece of news, even setbacks, is ultimately bullish for Bitcoin because it exposes weaknesses in fiat and strengthens Bitcoin’s narrative. So stay patient. The slow burn will be worth it.

See you in Vegas — and remember: best money wins.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.