- Bitcoin price hovers around $83,000 on Thursday after it failed to close above the $85,000 resistance level the previous day.

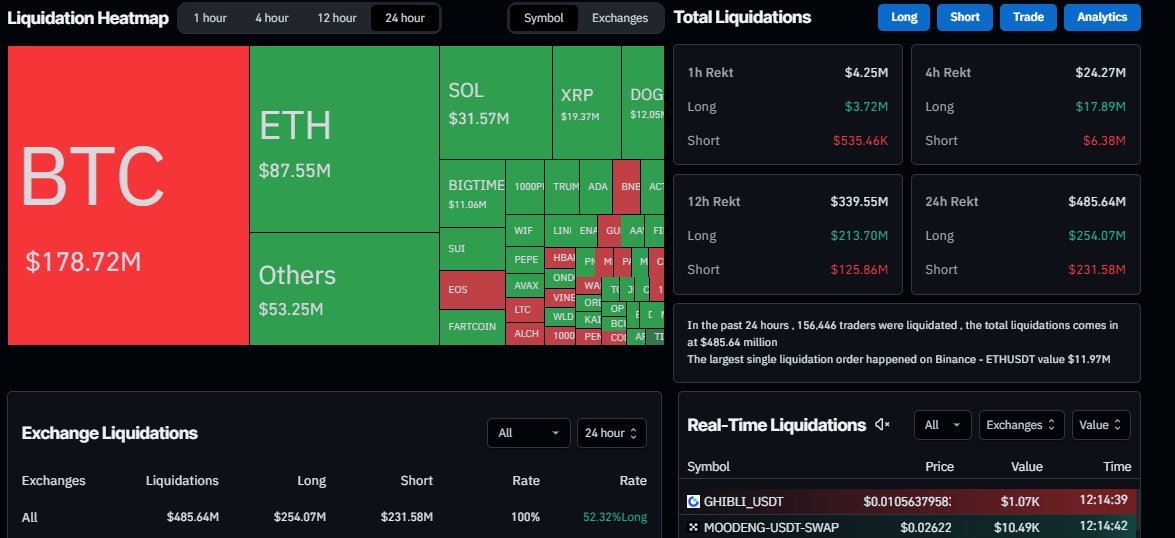

- Volatility fueled by Trump’s tariffs swept $200 billion from total market capitalization, liquidating over $178 million in BTC.

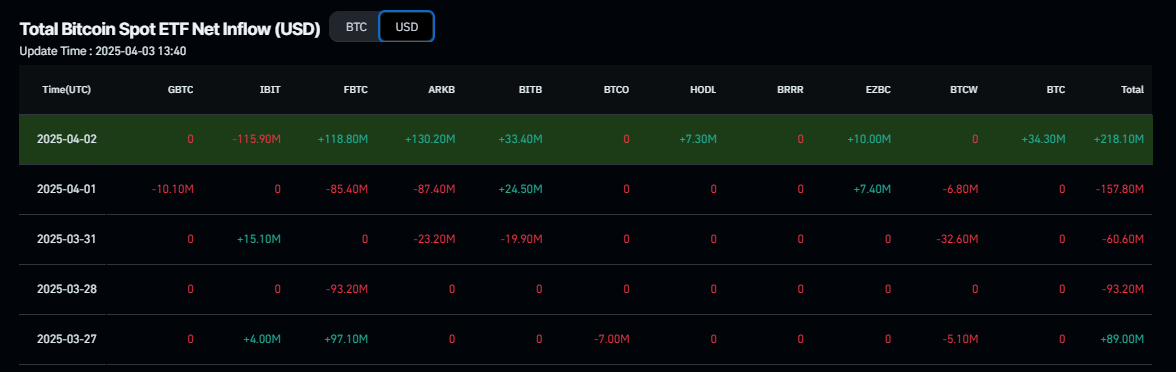

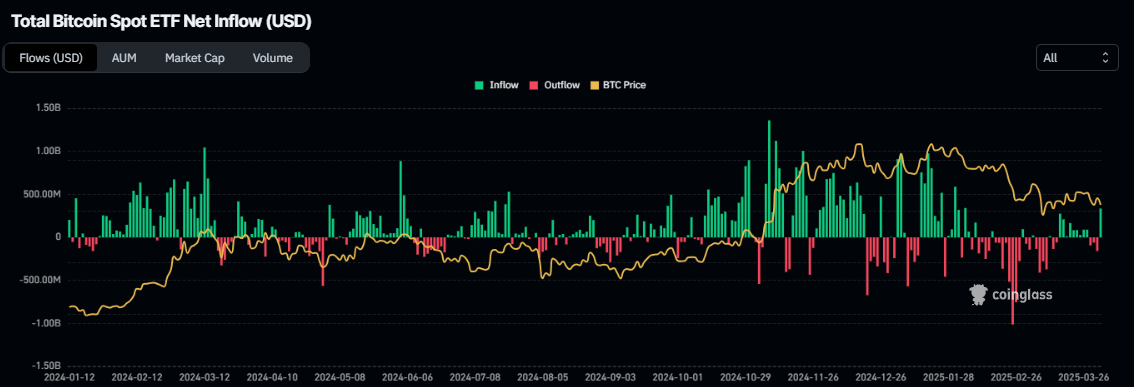

- Institutional investors bought the dips despite this price volatility as the US spot Bitcoin ETF recorded $218 million in inflows.

Bitcoin (BTC) price hovers around $83,000 at the time of writing on Thursday after it failed to close above a critical resistance level the previous day. Volatility in the crypto market is fueled by US President Donald Trump’s tariff announcement on Wednesday, which swept $200 billion from total market capitalization and liquidated over $178 million in BTC. Despite this price volatility, institutional investors bought the dips as the US spot Bitcoin Exchange Traded Funds (ETFs) recorded $218 million in inflows.

Tariff announcement brings volatility in BTC

President Trump announced tariffs on 185 countries at once on Wednesday’s so-called’ Liberation Day’, the most harsh tariff in over a century.

The news began with the Wall Street Journal report that the US would impose a 10% baseline tariff. While this was true, markets took it as ‘ALL’ reciprocal tariffs were 10%. Due to this, the US equity market saw a sharp rise, followed by the crypto market, with BTC reaching a high of $88,500. However, both equities and the crypto market took a U-turn at 4:26 PM ET when President Trump picked up the tariff poster on stage at his announcement.

“Before he picked up this poster, futures were up +2%. By 4:42 PM ET, futures had fallen -4% from their high as Trump listed new tariffs name by name,” says The Kobessi Letter report.

S&P 500 E-mini futures chart. Source: The Kobeissi Letter

The tariffs were calculated at half of the rate at which countries are currently charging the US. As for reference, China, which the US claims, currently charges 67% tariffs. This means a 34% tariff is coming for China and 20% for the European Union, which is clearly much more than the 10%.

This news triggered volatility in the crypto market as BTC declined from its high of $88,500 to its low of $82,320 on Wednesday, wiping $200 billion from the total crypto market cap and $178.72 million in liquidation on BTC, as shown in the graph below.

Liquidation chart. Source: Coinglass

Institutional investors bought Bitcoin dips

According to Coinglass, Bitcoin spot ETF data recorded an inflow of $218.10 million on Wednesday, breaking its long streak of outflows since Friday. This inflow shows that institutional investors bought the recent price dip. If this inflow continues and intensifies, Bitcoin’s price could see a recovery ahead.

Total Bitcoin Spot ETF net inflow chart. Source: Coinglass

Bitcoin Price Forecast: BTC shows weakness as it fails to close above $85,000

Bitcoin was rejected by the 50% Fibonacci retracement (drawn from its November low of $66,835 to its all-time high of $109,588 in January) at $88,211 and declined 3.10% on Wednesday. Moreover, BTC failed to close above its daily resistance level of $85,000. This daily level roughly coincides with the 200-day Exponential Moving Average (EMA) and a descending trendline, making it a key resistance zone. At the time of writing on Thursday, BTC recovers slightly, hovering around $83,000.

The Relative Strength Index (RSI) indicator on the daily chart reads 46 after being rejected from its neutral level of 50 on Tuesday, indicating slight bearish momentum. If the RSI continues to slide downwards, the bearish momentum will increase, leading to a sharp fall in the BTC price.

The Moving Average Convergence Divergence (MACD) lines coil against each other, indicating indecisiveness among traders.

If BTC continues to find rejection from the daily resistance at $85,000, it could extend the decline to retest its next support level at $78,258.

BTC/USDT daily chart

However, if BTC recovers and closes above its daily resistance at $85,000, it could extend the recovery rally to the key psychological level of $90,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.